Popular price points of ₹2, 5, 10 and 20 for daily essentials are likely to make a comeback by mid-November following the government’s clarification to some fast-moving consumer goods (FMCG) manufacturers that they can increase pack weights instead of reducing prices to pass on the benefits of goods and services tax (GST) rate cuts to consumers.

After the government reduced GST rates with effect from September 22, FMCG firms were forced to move out of the popular price points in absence of a government clarification regarding increasing pack weights. For instance, a ₹5 pack had to be repriced at ₹4.45, a ₹1 candy at about 88 paise and a ₹2 shampoo sachet at about ₹1.77, causing inconvenience to consumers.

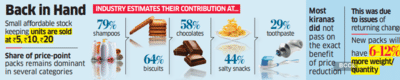

Industry executives said that with a verbal clarification from Central Board of Indirect Taxes and Customs officials in meetings with FMCG firms, fresh production will start in the next week or two for new packs at the popular price points, but with a 6-12% increase in weight or volume.

“Over the next few days, companies will roll out new packs at the popular price points and increased weight,” said Mayank Shah, vice president at Parle Products, India’s leading biscuit manufacturer.

He said fresh production has already started in the snacks industry with higher weights and old price points, since these products don’t need any major pack modification.

“For other categories, pack sizes need to be modified. So, that work is under process and then fresh production will start,” said Shah.

For biscuits, the pack weight will increase 11-12%, he said.

Angelo George, chief executive at Bisleri International, the country’s largest packaged water maker, said it’s a matter of time before companies go back to the popular price points with higher pack volume. “The current price points are inconvenient for consumers,” he said.

All companies reduced prices after the government slashed GST rates. Parle’s ₹5 pack of Parle-G was repriced at ₹4.45. Mondelez, India's biggest confectioner, revised prices of all products and packs to non-standard ones — for instance, Bournvita from ₹30 to ₹26.69, Oreo cookies from ₹10 to ₹8.90 and the ₹20 pack of Gems and 5Star to ₹17.8 each. Bisleri reduced the price of 500 ml bottled water to ₹9 from ₹10, and of the one litre one to ₹18 from ₹20.

However, most kirana stores resorted to rounding off the price or returning the change by giving packs of confectionery. Some did charge the exact amount for consumers paying through the Unified Payments Interface digital payment system. Retail chains and quick commerce platforms, too, revised prices.

Tarun Arora, chief executive of Zydus Wellness, the maker of Complan and Glucon-D, said popular price tags make sense from a consumer perspective and are easy for both marketing and small retail. "It’s still early days, but companies might respond by launching new products at magic price points or even consider reaching out to regulators for guidance or relief," he said.

Many companies maintain lower and popular price points even at times of high inflation, by reducing the quantity in packs.

In 2017, several FMCG firms were fined by the National Anti-Profiteering Authority for allegedly not passing on the benefits to consumers following the introduction of the GST regime.

An executive said they had received clarification from the government that this would not happen now in case firms reintroduced the convenient price points by increasing the weight or volume of products.

Dairy products maker Amul, however, said it will not go back to the popular price points until the government issues a formal notification. “The government’s intent was to lower pricing and we will follow it in letter and spirit. We do not intend to revise the prices and increase grammage because consumers will not get the intended benefit,” said Jayen Mehta, managing director of the Gujarat Cooperative Milk Marketing Federation, which markets products under the Amul brand.

Last month, Prashant Peres, managing director at Kellanova India and South Asia, told ET that price tags in between the magic price points were inconvenient for the larger industry. “So, in the short term, there will be some slashing of prices that we will do, or many others will do, because we just can’t turn around the supply chain fast enough. But in the long term, it will be grammage, and we will go to those price points,” he said.

After the government reduced GST rates with effect from September 22, FMCG firms were forced to move out of the popular price points in absence of a government clarification regarding increasing pack weights. For instance, a ₹5 pack had to be repriced at ₹4.45, a ₹1 candy at about 88 paise and a ₹2 shampoo sachet at about ₹1.77, causing inconvenience to consumers.

Industry executives said that with a verbal clarification from Central Board of Indirect Taxes and Customs officials in meetings with FMCG firms, fresh production will start in the next week or two for new packs at the popular price points, but with a 6-12% increase in weight or volume.

“Over the next few days, companies will roll out new packs at the popular price points and increased weight,” said Mayank Shah, vice president at Parle Products, India’s leading biscuit manufacturer.

He said fresh production has already started in the snacks industry with higher weights and old price points, since these products don’t need any major pack modification.

“For other categories, pack sizes need to be modified. So, that work is under process and then fresh production will start,” said Shah.

For biscuits, the pack weight will increase 11-12%, he said.

Angelo George, chief executive at Bisleri International, the country’s largest packaged water maker, said it’s a matter of time before companies go back to the popular price points with higher pack volume. “The current price points are inconvenient for consumers,” he said.

All companies reduced prices after the government slashed GST rates. Parle’s ₹5 pack of Parle-G was repriced at ₹4.45. Mondelez, India's biggest confectioner, revised prices of all products and packs to non-standard ones — for instance, Bournvita from ₹30 to ₹26.69, Oreo cookies from ₹10 to ₹8.90 and the ₹20 pack of Gems and 5Star to ₹17.8 each. Bisleri reduced the price of 500 ml bottled water to ₹9 from ₹10, and of the one litre one to ₹18 from ₹20.

However, most kirana stores resorted to rounding off the price or returning the change by giving packs of confectionery. Some did charge the exact amount for consumers paying through the Unified Payments Interface digital payment system. Retail chains and quick commerce platforms, too, revised prices.

Tarun Arora, chief executive of Zydus Wellness, the maker of Complan and Glucon-D, said popular price tags make sense from a consumer perspective and are easy for both marketing and small retail. "It’s still early days, but companies might respond by launching new products at magic price points or even consider reaching out to regulators for guidance or relief," he said.

Many companies maintain lower and popular price points even at times of high inflation, by reducing the quantity in packs.

In 2017, several FMCG firms were fined by the National Anti-Profiteering Authority for allegedly not passing on the benefits to consumers following the introduction of the GST regime.

An executive said they had received clarification from the government that this would not happen now in case firms reintroduced the convenient price points by increasing the weight or volume of products.

Dairy products maker Amul, however, said it will not go back to the popular price points until the government issues a formal notification. “The government’s intent was to lower pricing and we will follow it in letter and spirit. We do not intend to revise the prices and increase grammage because consumers will not get the intended benefit,” said Jayen Mehta, managing director of the Gujarat Cooperative Milk Marketing Federation, which markets products under the Amul brand.

Last month, Prashant Peres, managing director at Kellanova India and South Asia, told ET that price tags in between the magic price points were inconvenient for the larger industry. “So, in the short term, there will be some slashing of prices that we will do, or many others will do, because we just can’t turn around the supply chain fast enough. But in the long term, it will be grammage, and we will go to those price points,” he said.

You may also like

Kerala: LoP Satheesan slams CM Vijayan for his 'fascist' approach to ASHA workers' protest

PM Modi urges people to have darshan of 'Jore Sahib' during Guru Charan Yatra

Rajnath Singh to visit Jaisalmer tomorrow to attend Army Commander's Conference

BBC star makes huge TV return with co-star in Christmas special

Ronnie O'Sullivan signs up for new event with world champion after quitting UK