This past week, the government dropped a bombshell on the Indian startup ecosystem — the ‘Promotion and Regulation of Online Gaming Bill, 2025’.

For the real money gaming (RMG) industry, which is already grappling with a hostile landscape of state-level regulations, punitive taxes and ongoing litigations for the past three years, the new law sounds a death knell for this nascent segment.

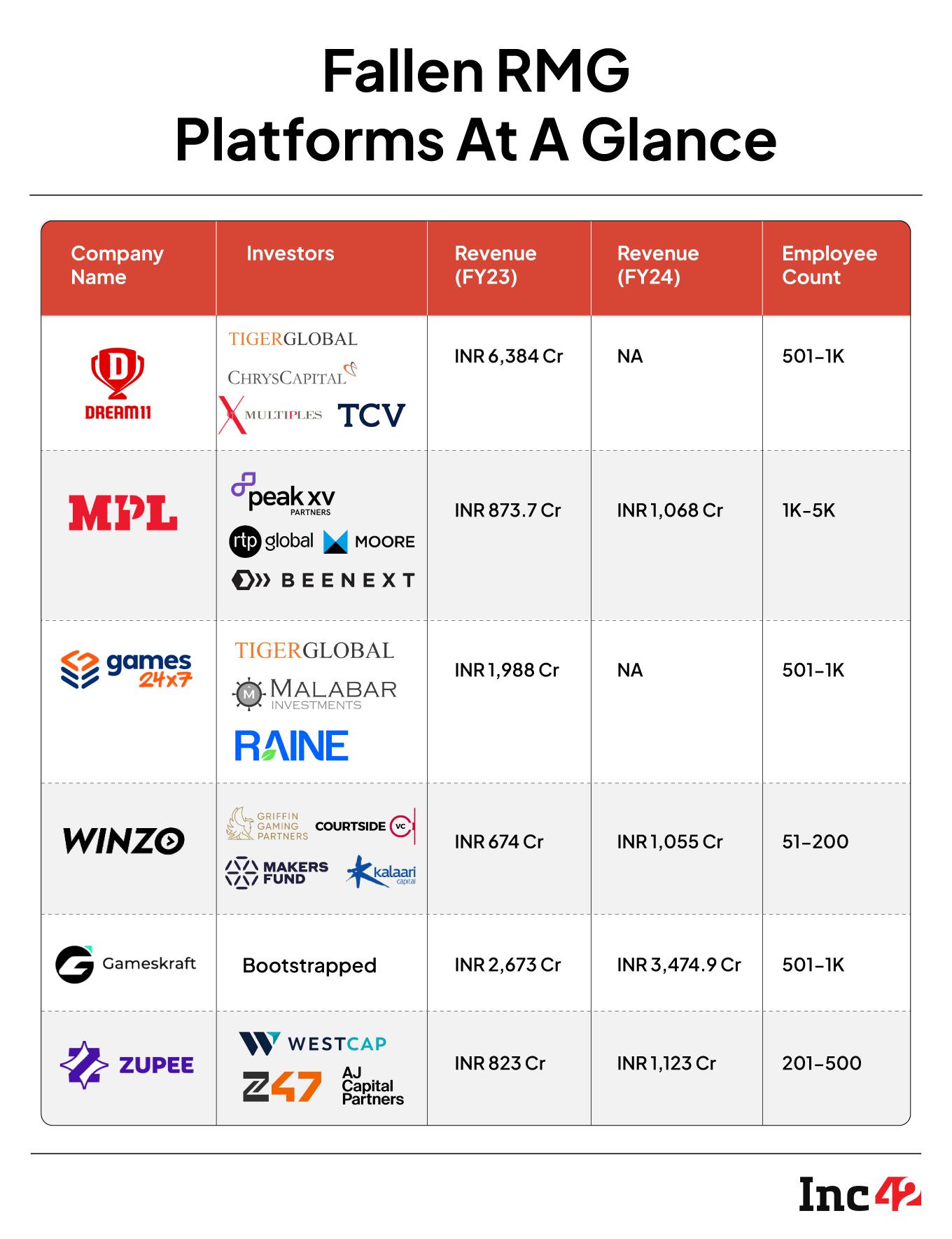

The nightmare began on Monday and had already secured presidential assent by Friday. The target? A $2.4 Bn industry where unicorns like MPL, Dream11, and Games24x7 gallop and thrive happily, but are now forced to go into hibernation. In the last few days, nearly a dozen startups have gone into limbo, terminating their real-money gaming operations.

Most notable of all is Dream11’s pivot to fintech, with parent entity Dream Sports stepping into the investment tech space through the launch of Dream Money.

So, what has triggered this sudden crackdown on one of India’s fastest-growing sectors? And what does the new law entail?

The legislation imposes a blanket ban on all online games involving money and bars financial institutions from facilitating any transactions related to such platforms. Offering or facilitating such services is punishable with imprisonment up to three years or a fine up to INR 1 Cr, or both.

Still, while the sudden ban came as a shock, the warning signs had been visible for years. Now, before we dive into the fallout and the damage this bill has caused to a sector that employs nearly 2.5 lakh people, here are the top stories from our newsroom this week:

India’s Neobanking Mirage: It looks like India’s neobanking fairytale is reaching its final chapter, and it’s not a happy ending. Without digital bank licences, their over-dependence on traditional banks now haunts them. Result? Stifling revenue potential and stalled innovation.

Quantum Leaps Or Stumbles? India’s startup ecosystem is abuzz with the promise of quantum computing, but it seems this high-tech dream is hitting a few snags. With a talent gap, a funding chasm, and fabrication capacity constraints, is the country’s quantum journey facing its biggest litmus test yet?

RBI, Fintech & AI: The RBI has a new directive for India’s fintech – build an indigenous, responsible, AI-powered future! But this grand AI vision is causing a stir. Some are ready to embrace the new era, while others are wondering if the RBI’s dream is a bit of a stretch.

A Storm Long In The BrewingFor all the industry’s arguments about the distinction between games of skill and games of chance, the reality on the ground was undeniable. The pitch was simple and seductive – “deposit INR 10 and win INR 100”.

These apps spread like wildfire, fuelled by a unique mix of unemployed youth, cheap data, and affordable smartphones. What began as a digital gold rush soon turned into an obsession, even transforming simple games like Ludo into high-stakes gambling. And, the ripples were far-reaching.

Just last month, reports surfaced that a soldier lost INR 40 Lakh of his life savings on RummyCircle, after what began as a casual wager spiralled into a devastating addiction.

In India’s hinterlands, stories are even more harrowing — people earning just INR 10,000 a month borrowing as much as INR 80 Lakh in a desperate bid to outdo their losses.

In June, a couple in Rajasthan reportedly took their own lives, crushed by online gaming debt. In total, authorities have recorded 32 deaths by suicide in less than three years — a chilling testament to the human cost of the RMG boom.

Overall, an estimated 450 Mn users were losing nearly INR 20,000 Cr annually.

While the list of gambling deaths was growing, there was also the legislative limbo. For years, the regulatory landscape was a chaotic game. States like Andhra Pradesh, Odisha, Telangana and Tamil Nadu imposed bans, but only to see them challenged and overturned in courts. Without a central mandate, state laws were toothless.

A 2023 attempt by the central government to establish industry-led self-regulatory bodies (SRBs) also fell flat. What’s ironic is that these regulatory bodies were themselves led by RMG giants, leading to concerns over conflict of interest.

Witnessing a growing debt crisis, failed state-level policies and a deepening social crisis, the central government decided to step in.

Calling online gaming a bigger menace than drugs in the country, IT minister Ashwini Vaishnaw listed the following key reasons in support of the bill:

- Protection of society, especially the youth and middle-class families, from the social menace of online money gaming.

- Ineffective self-regulation and the growing harm to society necessitated strong government action

- Reports of many such platforms being involved in money laundering and even terror funding

Despite the ban, Vaishnaw affirmed the government’s strong support to support esports and social gaming. He believes this will help grow the creator economy, create new jobs, and position India as a global hub for game development.

Between 2020 and 2024, investors poured nearly $700 Mn into RMG ventures. They are now left staring at an uncertain future, as once-thriving startups slip into hibernation, scrambling to pivot to free-to-play formats while rushing to reassure users their funds remain safe.

Industry giants were the first to fall in line. Within a few hours of the President’s assent to the bill, gaming unicorn Games24×7 halted all cash games on its flagship app, Rummy Circle, though users can still play “fun practice games”. Its fantasy platform, My11Circle, followed suit, shutting down real-money contests and allowing only free play.

Rival fantasy sports giants Dream11 and MPL have also paused cash contests. Other major platforms, including PokerBaazi, WinZO, and Rush by Hike, have either ceased operations or shifted focus, pointing to a widespread disruption in the RMG sector.

Not just unicorns, shivers were felt across bootstrapped startups. Platforms like Gameskraft and Zupee also paused cash gaming options, while opinion trading platform Probo, too, has discontinued paid offerings, submitting to the new regime.

On the bourses, Nazara, the listed gaming major, had no choice but to endure the anxiety of fearful retail investors. The company’s stock fell 12% on the day the bill was announced and kept sliding, shedding INR 245 in just three days. This came despite the company insisting it had little to no exposure to RMG revenues. The panic sell-off may have been triggered by its stake in Moonshine Technologies, the operator of PokerBaazi, which has since shut down its operations.

Amid the turmoil, the potential fallout for India’s gaming sector is staggering.

In the wreckage of India’s RMG industry, the debate has shifted from what happened to why. The government’s decision to use a hammer instead of a scalpel has left founders and investors questioning not just the timing of the ban, but the very logic behind choosing prohibition over regulation.

One prominent RMG founder captured the industry’s frustration – “if the ethical case against real money gaming was so clear, why did the government take so long to act?” The inconsistency is striking, he argued, pointing out that cryptocurrency remains legal despite comparable risks around money laundering and financial loss.

So, could the government have done anything differently? Well…

For years, the industry’s giants lobbied for a clear line to be drawn between games of skill and games of chance. But they were advocating for a distinction that the legal system could never truly define. This ambiguity became a regulatory black hole.

Courts, all the way to the Supreme Court, were unable to establish a definitive mathematical or statistical model to settle the debate, which relied on subjective interpretations. Trapped in this regulatory quicksand and frustrated by the industry’s use of legal loopholes, the government eventually concluded it was a Sisyphean task.

The semantics of skill versus chance, the Centre realised, were largely irrelevant, and the only factor that truly mattered was whether money was at stake.

In the face of widespread social ruin, the nuanced distinction between skill and chance became a luxury the government was no longer willing to afford.

However, many still believe a middle path was there.

Instead of a blanket ban, the government could have formulated a stricter compliance and monitoring framework for RMG platforms, much like other tech segments. A system built on strict licensing, ironclad age verification processes, mandatory responsible gaming features and rigorous financial audits could have addressed the social harms.

But, all said and done, the game is now over for the $20 Bn gaming ecosystem. It has been entirely decimated and bulldozed to the ground. What could be salvaged is all that matters.

What’s Next?Nobody knows… The aftermath of the ban has forced online gaming companies to rethink their survival strategy. Dream11, once the poster child of India’s gaming startups, is reportedly exploring pivots beyond money-led formats. Others may now be looking to quietly shift operations to Singapore, where policy is more stable and taxation more predictable, according to industry sources.

The death knell has left thousands of employees facing an uncertain future, raising tough questions about the social cost of abrupt policymaking.

For years, India has showcased itself as a champion of ease of doing business. This promise of regulatory stability has long wooed global investors, who have helped Indian entrepreneurs build some of the world’s most valuable startups, even in the gaming segment.

Yet, today, we stand at the crossroads of a stark paradox, witnessing an entire industry being wiped out overnight.

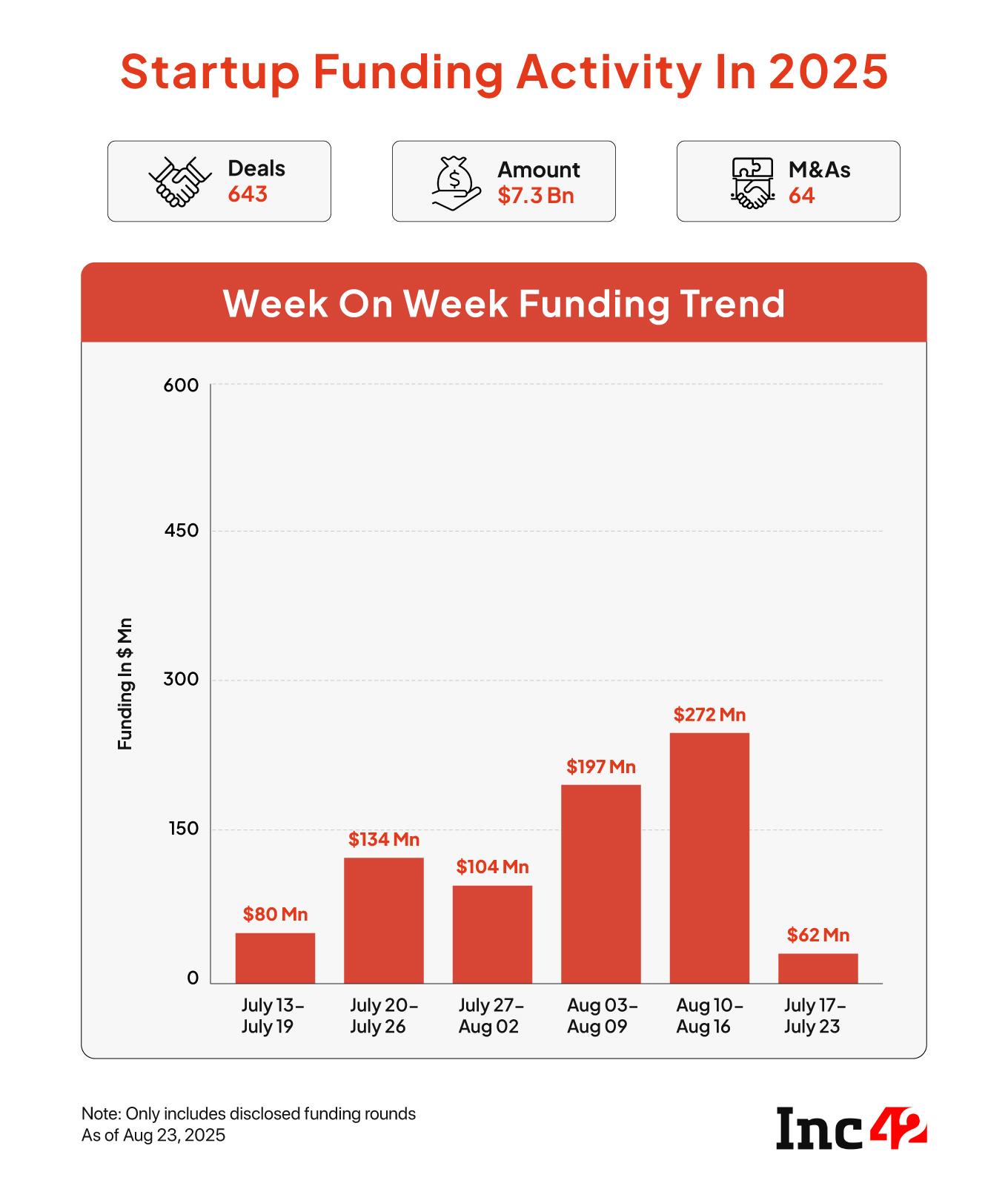

Sunday Roundup: Startup Funding, Deals & MoreInvestors Hold Back Cash: Indian startups raised just $62.2 Mn this week, a steep 77% drop from last week’s $272 Mn. Ecommerce led with $33.6 Mn, while seed funding nosedived 84% to $2 Mn across four deals.

Avanse IPO In Limbo: Education loan NBFC Avanse Financial may delay its INR 3,500 Cr IPO as US visa curbs dampen overseas loan demand. Despite SEBI nod, the lender hasn’t filed its RHP, raising uncertainty around its listing.

Bike Taxis Back On Track: After nearly two months, bike taxis are back in Bengaluru as Uber and Rapido resume services. Ola is expected to follow, after the Karnataka HC questioned the state’s blanket ban on bike taxis.

Foxconn Faces India-China Strain: Foxconn’s unit Yuzhan has recalled 300 Chinese engineers from its Tamil Nadu plant, its second such move recently. The iPhone supplier is now relying on Taiwanese and other foreign staff to keep expansion on track.

India-Made Chip By Dec: India’s first packaged semiconductor chip is expected by December 2025. The milestone aligns with India’s vision to build a complete chip ecosystem spanning design, fabrication, packaging, and global exports.

[Edited by Shishir Parasher]

The post Into India’s Gaming Wasteland appeared first on Inc42 Media.

You may also like

Cong leader joins Kerala Oppn in mounting pressure on Rahul Mamkootathil to resign

Weather department forecasts week-long rain in Bengal

'Restrict freedom outside jail too': UK Labour govt cracks down on criminals; offenders may face ban from public venues

Alison Hammond's engagement joy with toyboy boyfriend - 'On top of the world'

Postman Will Now Bring Mutual Funds Too, 1 Lakh Postmen To Get Training – Investments Possible Via Post Office