Last week, Zepto grabbed headlines again, but this time for reasons that could shape its future. First, it raised INR 400 Cr from Motilal Oswal, and second, it finally revised the app’s free delivery terms in line with rivals Blinkit and Swiggy Instamart.

To novice eyes, the two developments may seem fathoms apart — one being a routine fundraising, the other just an app tweak. But both are strategic — polishing the optics and strengthening fundamentals before the IPO.

Motilal Oswal’s increase in stake boosts Indian institutional ownership, signalling local investors’ confidence, which could act as a pivotal psychological anchor for retail investors during its IPO.

On the other hand, the app update fixes a reputational sore point around dark patterns, which have long been criticised and risked carrying negative sentiments into the public market.

Notwithstanding this, here’s an irony you might have zoomed past —the startup synonymous with speed, either for delivering groceries or raising funds, is snailing its way to the D-Street.

Now, before we answer this, let’s steal a glance at the top news stories from our newsroom this week:

Defence In The Age Of AI: India’s defence tech startups aren’t sitting on the sidelines — they’re busy building the tools that could shape the future of national security. However, with the global AI military market set to more than double to $35 Bn by 2030, is India ready to grab its moment?

BharatPe Beyond Lending: BharatPe has swung into the green, posting INR 6 Cr profit (excluding ESOP costs) in FY24. The credit goes largely to its thriving merchant lending arm. But can BharatPe grow into a full-fledged fintech powerhouse, or will it remain a digital lender dressed up as one?

Inside Nykaa’s Q1 Vanity Box: The beauty ecommerce giant is rolling in profits, jumping nearly 80% YoY in Q1 FY26. So, what’s its secret? Turns out, it’s a trifecta of winning moves – a booming offline presence, a glamorous lineup of new international brands, and a clever house of brands strategy that’s giving them a healthy glow on the balance sheet.

Lately, Zepto’s breakneck expansion seems to be losing steam. Nowhere is it more evident than in Zepto Cafe, its quick food delivery vertical. Founder Aadit Palicha, who was too vocal about Zepto Cafe’s quarterly metrics on social media, has gone awfully silent.

However, how can one quantify silence? But if you seek hard numbers, then the vertical has shuttered 45-50 outlets due to sourcing bottlenecks and a dearth of trained kitchen staff.

Media reports suggest that the order volume has halved from the peak of 1 lakh daily, just as rivals Swiggy’s Snacc and Eternal’s Bistro push aggressively in the space.

Marketing for Zepto Cafe has virtually disappeared, a sharp divergence from the months when it was at the front and centre of Zepto’s growth story.

However, this slowdown is not just confined to food — Zepto’s bread and butter grocery segment, too, is losing its momentum.

After tripling its gross merchandise value (GMV) to $3 Bn in just eight weeks in January this year, as claimed by Palicha, the startup couldn’t touch $4 Bn in GMV in April 2025, a sign of plateauing growth. The sudden loss in momentum could mean shifting priorities from raw expansion to operational stability.

Job cuts at Zepto Cafe are a part of a wider cost discipline pivot by Zepto. The startup, which was once the embodiment of blitzscaling, is now more selective in its capital deployment.

Dark store expansion, the backbone of quick commerce delivery promises, has slowed sharply. According to JP Morgan, Zepto added only 105 dark stores as of March 2025, less than half the pace of Blinkit and Instamart.

Between April and May, the gap widened further. Zepto added 22 stores, while Instamart added 118 and Blinkit added 98. The shift has significant competitive implications. Instamart now leads Zepto in store count.

Internally, headcount reductions have accompanied the slowdown, and discounts have been pared back to improve margins. More importantly, the startup’s deliberate plan to increase Indian ownership will allow it to shift to an inventory-led model, giving Zepto greater command over the entire supply chain and better margins.

This aligns with the startup’s effort to improve unit economics before going public. While revenue growth remains impressive at INR 11,100 Cr in FY25, 149% higher than INR 4,454 Cr in FY24, profitability continues to remain elusive.

Public market history is instructive here. Both Swiggy and Zomato have faced sharp stock price corrections whenever their margin dropped. For Zepto, going public without a clear path to profitability could attract a similar fate.

As Zepto continues to scale back, its entry into medicine delivery looks like a high-risk gamble. On paper, the vertical is supposed to increase the average order value and capitalise on the growing online pharmacy market. But the execution challenges are formidable. A separate and highly regulated supply chain, strict compliance protocols, and the need for a specialised storage infrastructure are a few to name.

The competitive environment is equally unforgiving. Blinkit and Instamart have already entered the space, leveraging their existing delivery infrastructure.

Meanwhile, players like PharmEasy and Tata 1mg, which have been selling medicines online for almost half a decade, are still far from being profitable.

For Zepto, which is currently fixing its unit economics, the timing of this entry is questionable, though the company will be banking on pharma deliveries to be the next growth lever.

Besides, brand positioning is another layer of complexity that Zepto needs to address. Moving from fast groceries to trusted medicines requires not just marketing but also a shift in consumer perception.

Zepto was initially expected to file its IPO papers by mid-2025. This timeline has shifted. While the company’s recent INR 400 Cr fundraise is expected to keep it cushioned until it raises its rumoured $500 Mn funding at $7 Bn valuation, the uncomfortable truth is that Zepto is heavily dependent on external capital for growth.

The current scheme of things makes us ponder — when will Zepto generate enough operational cash to fund expansion organically?

As of now, the startup’s pause seems to be a deliberate tactic to allow operational efficiencies to catch up to top-line growth before facing public scrutiny. While piggybacking on its likely $500 Mn fundraise, the startup may scale again, but in the hypercompetitive quick commerce landscape, slowing down is an open invitation for rivals to invade.

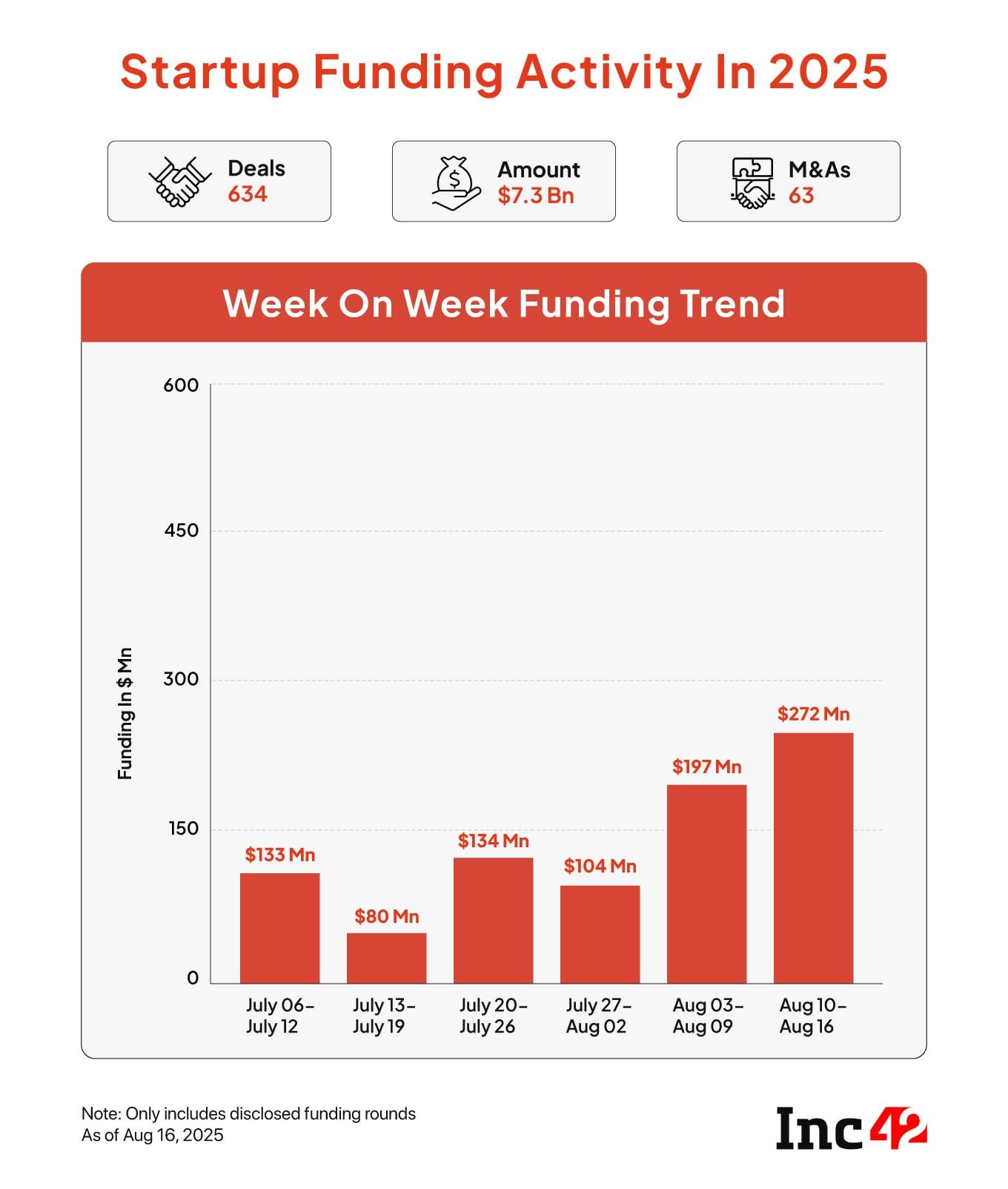

Sunday Roundup: Startup Funding, Deals & More- Funding Galore: Investment activity across India’s startup ecosystem gained further steam this week, buoyed by marquee deals. Between August 11 and 16, startups mopped up $272.1 Mn across 18 deals, up 38% from the $197.4 Mn garnered by 25 startups last week, even as deal count slipped 28%.

- Lifelong’s New Lifeline: D2C consumer durables brand Lifelong Online has raised $13 Mn (INR 114 Cr) from existing backers at a post-money valuation of $500 Mn (INR 4,000 Cr). Set up in 2015, the startup sells products across two categories: home and kitchen, and health and fitness.

- Darwinbox Gets Fresh Capital: Months after raising $140 Mn, HRtech unicorn Darwinbox has bagged an additional $40 Mn from Ontario Teachers’ Pension Plan. Founded in 2015, Darwinbox is an HRMS platform that supports essential human resource functions.

- Uber Drivers Get Pass: After Rapido and Ola, Uber has also rolled out its SaaS-based zero-commission model for cab drivers. A new ‘Driver Pass’ option on the app lets drivers buy multi-day subscriptions instead of paying per-ride commissions.

The post Zepto’s IPO Crawl appeared first on Inc42 Media.

You may also like

GST reforms to bring double bonus for Diwali: PM Modi

Young Delhi techie considers quitting Rs 30 LPA job even without another offer: 'Sick leave just means WFH'

Keir Starmer to join Ukraine's Zelensky for crunch talks with Donald Trump at White House

Upbeat over bypoll win, CM Naidu may go aggressively against Jagan in Pulivendula

Oliver Glasner makes Eberechi Eze feelings very clear after Crystal Palace U-turn